Insights

How can regulated funds start holding crypto assets internally?

Ever since Elon Musk purchased $1.5B worth of Bitcoin for Tesla on the 15th of February, 2021, almost every single major corporation started thinking about a way to buy, hold, and even accept cryptocurrencies from their customers.

And as public sentiment for Bitcoin & other coins is growing, hedge funds are also in a position where they have to figure out a way to implement cryptocurrencies in their portfolios in a safe & secure way.

To achieve this, most funds make use of managed financial products and don’t hold the assets themselves. But they don't have to necessarily do this. Self-custody is easy to do by utilizing smart contracts.

So if a company wants to offer their customers simple investment products as cryptocurrencies, the invested funds have to be converted into crypto somehow via a third-party, which can lead to several problems.

A better solution is to hold these cryptocurrencies internally, using not just a regular wallet but something called a “Multisig Wallet”.

This solves two major problems:

- It gives an extra layer of security when an employee loses their device or private key

- It protects against outside hacking attempts or attacks on individual employees

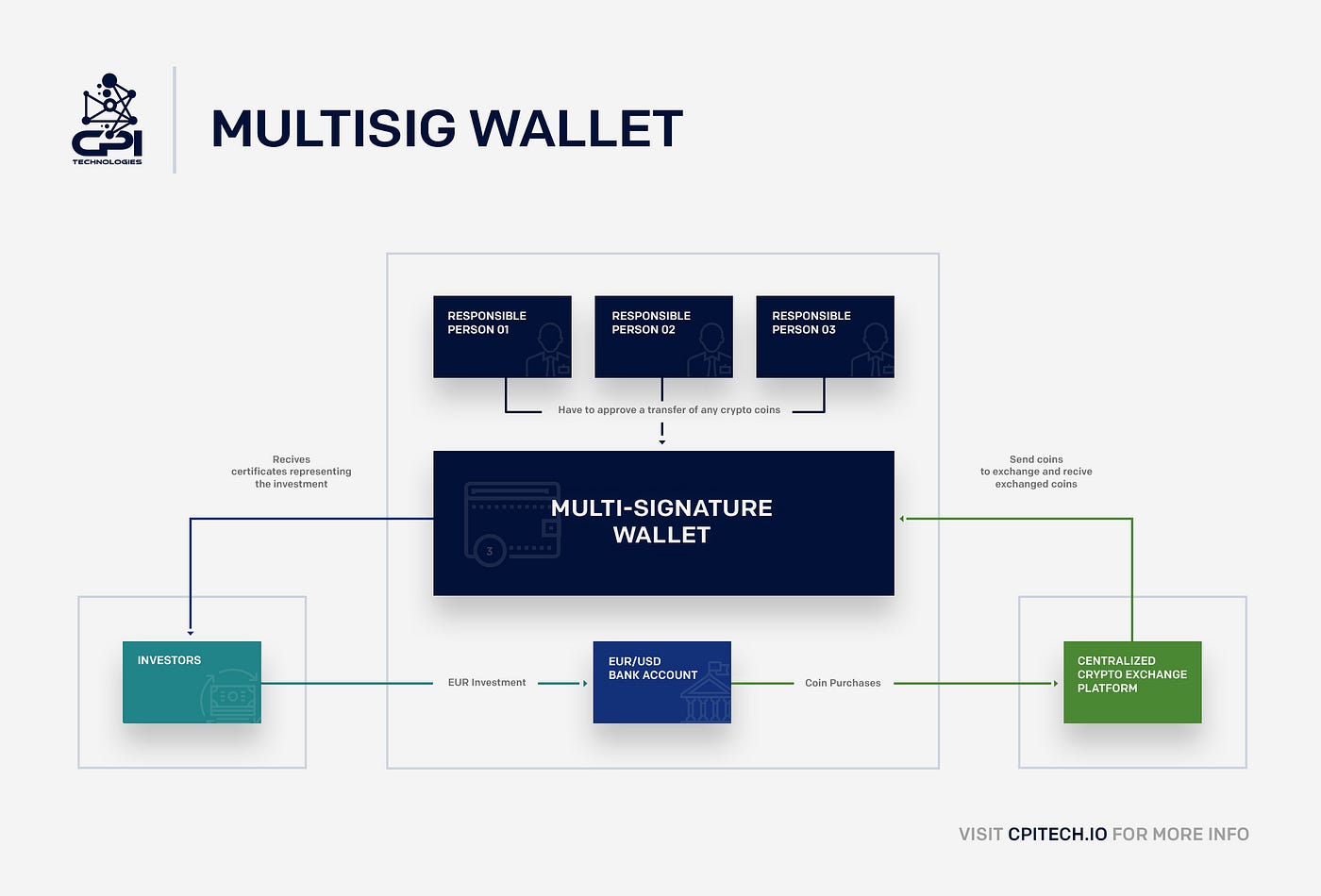

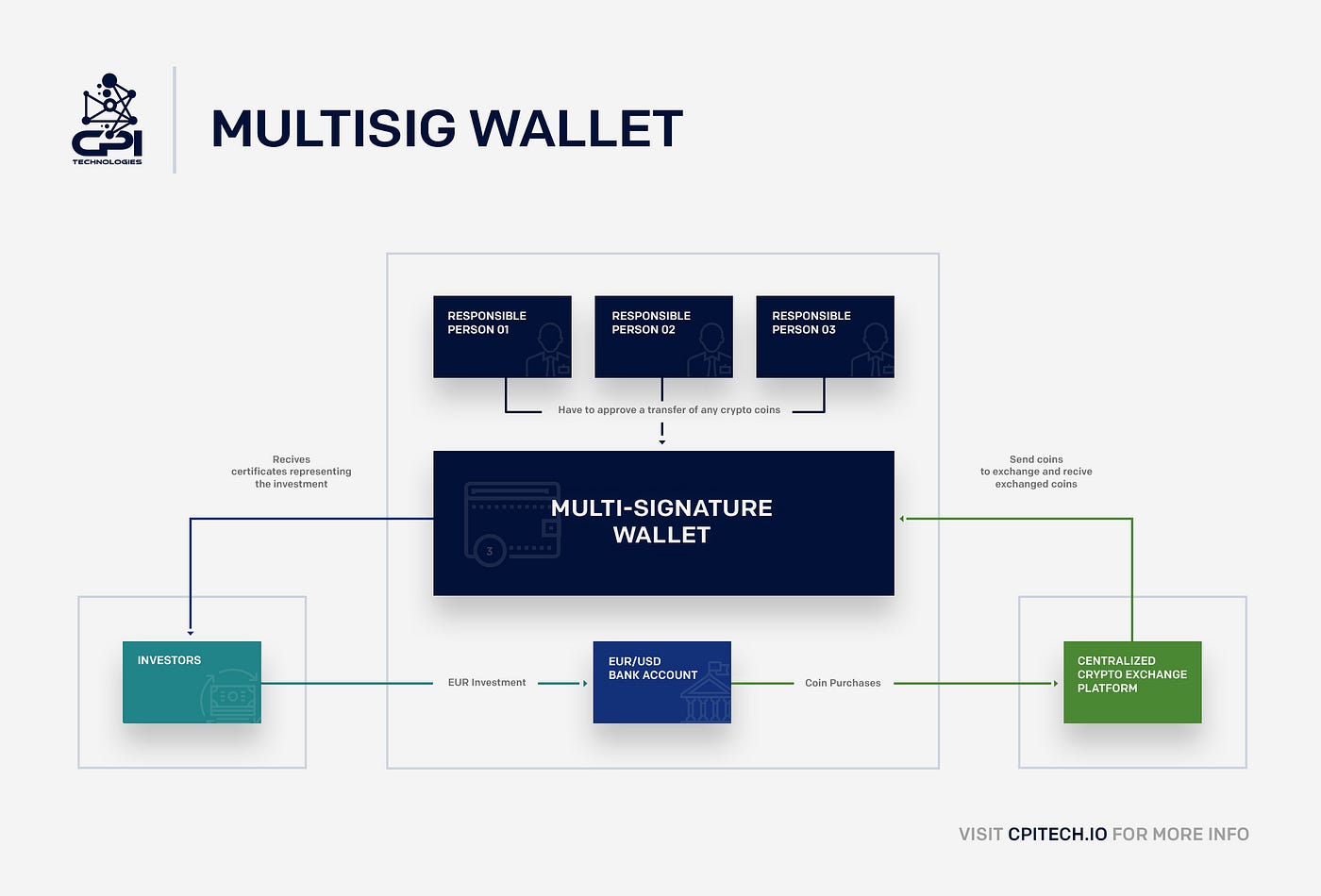

Using a “Multi-signature Wallet” (or Multisig for short), the owner can define core rules such as how many people have to approve a transfer out of the company’s wallet or convert it into fiat money.

For example, let’s say you want to name 3 responsible persons.

With a Multisig Wallet, you can easily set a rule that at least 2/3 of people have to approve a transfer of any crypto coins.

And the same could work with 3/5 or 4/8 — the specifics are up to the company to decide.

As a result, even if an employee gets compromised or is forced to send out funds to a malicious receiver, the transaction simply won’t go through.

Also, even if one of the 3 people loses access to their account, the other 2 people are still able to act without them.

Here’s a handy step-by-step illustration that shows exactly how the entire process works from end-to-end:

- An investor moves funds to the bank account of the hedge fund. They automatically get issued a certificate (e.g. with an ISIN number) that represents their investment and is accepted by the bank/broker of the investor.

- With the funds on the bank account of the hedge fund, it’s now possible to go to any exchange or OTC platform on the market and exchange the fiat funds into cryptocurrencies.

- As exchanges are an unsafe place to store the cryptocurrencies long-term, they will have to withdraw the coins and store them on the company’s internal wallet

- So they send these coins to the company’s internal Multisig wallet, where multiple responsible people have to approve a transfer for funds to be moved outside the wallet

- With this internal infrastructure, companies can hold, buy, and sell cryptocurrencies securely and easily with the funds of investors or of the company

And the best part?

Building up such an infrastructure can be done very fast and allows anyone to launch crypto investment products centrally with ease.

By the way, the clients don’t necessarily have to understand how the internal infrastructure is built…

You only need to communicate your unique strategy of which coins are purchased and why (ex: they belong to the TOP20 coins, the tech-team considers them undervalued, etc).

Every fund knows best what’s interesting for its customers. But whatever the strategy is, you can easily execute it with such a basic infrastructure.

Contact

CPI Technologies GmbH, Anni-Eisler-Lehmann-Str. 3, 55122 Mainz, Germany

Newsletter Signup

Join our community and receive the latest news & updates about our company and our offers